Chime is a popular financial technology app that offers early direct deposits as one of its main features. But sometimes deposits can get stuck pending due to delays in processing. This comprehensive guide will explain what pending deposits are, reasons they occur, if and how Chime displays them, and steps users can take to either track or cancel stuck deposits.

What Are Pending Deposits

Pending deposits refer to funds that are in transition between your external bank account and your Chime spending account. They have been initiated but haven’t cleared yet, so the money is not available for use.

Some common reasons why deposits may be pending include:

- Bank transfers getting held up by external banks’ processing times.

- Transaction errors that cause delays in money movement.

- Security checks triggering holds before deposits clear.

- Scheduled deposits not being credited yet due to date rules.

Don’t worry if your deposit is stuck in pending status – in most cases, it will clear within 1-3 business days. However, it’s understandable to get anxious if you need urgent access to expected funds.

Does Chime Show Pending Deposits

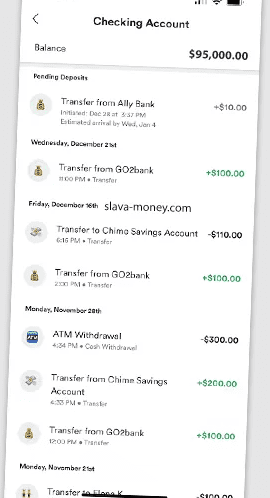

The good news is – yes, Chime does display pending deposits so you can track their status. But it doesn’t have a separate pending tab, rather shows them in your main account transaction list.

Here’s how you can view pending bank transfers or direct deposits on Chime:

- Log in to your Chime mobile app or website account.

- On the dashboard under account balance, click on “Transaction History”.

- Here you will see bank transfers or deposits with a gray pending status indicator.

So unlike some banking apps, Chime doesn’t isolate pending activities in a separate tab. But they do show currently pending deposits and reflect processing status directly in your transactions list.

How To Check Pending Deposits on Chime

While Chime displays pending deposits, sometimes the gray indicator doesn’t appear or correctly reflect status. Here are steps to check details:

Verify Transaction History

First, closely verify your Chime transaction history as outlined above – fresh pending deposits may take 24 hours to show. If it doesn’t reflect after a day or two, time to dig deeper.

Review Bank Transfer Timelines

Check processing timelines quoted by your external bank. If transfer initiation date is very recent, the fund may still be in transit between banks.

Contact Chime Support

You can call Chime support (1-844-244-6363) for deposit status – they can look up pending transfers internally and confirm expected clearing date. Email ([email protected]) also works.

Check Account Notifications

Enable account notifications on Chime to get status alerts when deposits are pending, processed or fail. Watch out for failure notifications.

Staying on top of pending deposits ensures you aren’t caught unaware if paychecks or transfers don’t arrive as scheduled.

Troubleshooting Tips for Stuck Deposits

Despite best efforts, deposits sometimes get stuck at pending for too long. Here is what you can try if your money stays locked without clearing:

Confirm External Account Details

Double check if initiator account details (like account/routing no, legal names etc.) were entered correctly during transfer. Errors can cause hiccups.

Dispute Failed Transfers

If a deposit finally fails or gets rejected, immediately file dispute forms with your bank to recover the money. Provide transaction details and request traces.

Adjust Scheduled Transfers

Check if you have outdated scheduled transfer dates which batch transfers only on weekdays. Pending over weekends is common.

Transfer via Debit Card

As fallback, consider instant options like debit card transfers or payment apps like Zelle. Useful for emergency funds if bank transfers stall.

Get Account Overrides

Ask Chime to provide temporary account overrides in case you need money deducted directly from pending deposits towards bills or payments.

Staying calm, being organized, and methodically checking all avenues is key to resolving lengthy pending deposits.

How To Cancel Pending Deposits on Chime

While troubleshooting stuck deposits, also know how to proactively cancel them in case needed. Like whenduplicates get initiated or transfers remain perpetually pending.

Follow these steps:

- Tap the profile icon on Chime mobile.

- Go to Settings > Manage Account.

- Choose scheduled transfers.

- Identify and edit problematic pending transfers.

- Select “Cancel Transfer” to delete it.

Cancelling from both ends (Chime and external bank) is needed to prevent future deposit attempts. If it’s an employer direct deposit, also notify payroll.

Understanding Chime’s Access to Funds Policy

Chime’s ability to display pending deposits gives users visibility. But it’s also important to understand their funds availabilitypolicies around deposit processing.

Some key aspects:

- Early Direct Deposit: Chime releases recurring payroll/benefits deposits up to 2 days early as courtesy to users. One-time deposits don’t qualify.

- Business Days: Chime only processes pending deposits on business days, excluding holidays and weekends. So don’t expect movement on federal holidays or Sundays even if displayed as pending.

- Access Delay: Deposits over $5,000 may have additional hold times before being fully accessible in Chime.

- Fraud Holds: Suspicious or unusually large pending deposits can trigger holds and account reviews by Chime fraud team. Statuses may be unclear until reviews complete.

So while visibility into pending deposits helps, actual availability of funds depends on these processing guardrails which Chime keeps consistent with banking regulations. Be mindful of these rules to avoid unexpected situations.

Best Practices To Avoid Pending Deposit Issues

By following some simple best practices, you can avoid most issues with stalled or stuck pending deposits:

- Set deposit reminders to regularly check statuses manually

- Enable notifications so Chime alerts you automatically

- Validate external account details before initiating each transfer

- Know typical processing timelines quoted by your bank

- Transfer money well in advance of any urgent bill deadlines

- Have backup payment options handy like debit card or peer-to-peer apps

- Maintain an emergency cash buffer as cushion against longer holds

- Proactively cancel pending deposits that get stuck or duplicated

The key is being organized, having visibility through Chime’s systems, and planning adequately to avoid getting impacted by unexpected delays.

Alternative Emergency Options If Funds Are Pending

Despite best efforts, some deposits inevitably get delayed at inconvenient times. Here are some emergency cash alternatives to cover you temporarily:

Payday loans

Payday loan apps like Dave, Earnin, and Brigit offer small-size short-term loans. Useful for filling urgent gaps but charge fees.

Overdraft from another account

Many banks allow overdraft transfers from linked accounts to fill shortfalls. Handy to know in a pinch.

Peer-to-peer payments

Cash App, PayPal, Zelle or Facebook Pay allow peer-to-peer transfers. Great to request temporary funds from family/friends.

Credit cards

As last resort, rely temporarily on low-interest credit cards. Ensure to make payments once pending deposits clear to avoid financing charges.

The key is avoiding a short-term crunch until your actual funds show up in Chime after clearing holds.

Deposits Stuck Past 5 Days? Next Troubleshooting Steps

If your pending deposit still shows no signs of clearing after 4-5 business days, it may indicate an underlying issue needs addressing.

Here are next-level troubleshooting tips:

- File a formal complaint with Chime’s regulatory authorities like the FDIC or CFPB citing persistent deposit delays

- Submit a dispute/claim to recover funds if the deposit finally gets rejected after excessive holds

- Request goodwill compensation from Chime if stalled deposits cause financial losses

- Close Chime account altogether if fed up of persistent pending deposit issues

- Explore legal routes if there is suspicion of unfair holding or denial of rightful deposits

The goal is to rule out a transient tech glitch, and identify if endemic account-level problems or policy gaps are leading to an abnormal rash of lengthy pending deposits.

Warnings Signs of Fraudulent Pending Deposits

While most pending deposits do eventually process, sometimes they can be red flags for fraudulent activities. Here are some warning signs of suspicious deposits:

- You didn’t initiate the deposit but still shows as pending

- Significant account inactivity followed by large deposit attempt

- Deposit amount seems random or disproportionately high

- Initiator account details look dubious or can’t be verified

Summarizing Key Takeaways

Despite Chime’s feature of displaying pending deposits, users may occasionally encounter temporary issues with transfers getting stuck. Here are main tips to retain control:

- Enable notifications so Chime alerts you automatically on deposit status changes

- Note processing time quotations provided for typical transfers

- Try instant options like debit cards or peer-to-peer apps if immediate need arises

- Vet any dubious-looking pending deposits thoroughly as fraud prevention

- Raise disputes without delay if legitimate rightful deposits ultimately fail or vanish

As Chime continues enhancing technology on their platform, preventative best practices combined with prompt troubleshooting should help users handle most pending deposit scenarios effectively.

The key lies in closely monitoring account activity, communicating concerns quickly with member services, and allowing reasonable (though not indefinitely long) processing times for transfers between bank systems.